Hard Insurance Market Australia

The Australian infrastructure insurance market has hardened significantly over the past 18 months alarmed by a run of major claims natural disasters and the Covid-19 pandemic. This means that in some cases it could be more difficult to find affordable coverage but your broker.

15 Best Luxury All Inclusive Resorts In The World Australia Tourist Attractions All Inclusive Resorts Inclusive Resorts

Insurance Ovum October 17 2017.

Hard insurance market australia. The insurance market is cyclical moving through both hard and soft markets. Why are we experiencing a Hard Insurance Market. As a result Australian contractors are facing one of the most difficult insurance markets in recent memory particularly but not only in relation to professional indemnity insurance.

How we can work with you. As relatively few insurers are offering coverage it can be expensive and difficult to obtain. Industrial Special Risk and General Liability Insurance Market Insights Australia Q2 2020.

2017 and 2018 have been reported as the costliest years in history due to a wave of worldwide disasters equating to higher reinsurance costs. Whilst more complex explanations exist for ease the insurance market is generally segregated into two fields a harder and a softer market. Industrial Special Risk and General Liability Insurance Market Insights Australia Q2 2020.

While you will most likely need to be prepared. As witnessed over the last 35 years or more all hard insurance markets come to an end however predicting the end of the current hard market has become more complex given the weather related events that have occurred in every State and Territory across Australia during 2019. On the other hand a soft market beyond auto and property-catastrophe lines continues to prevail with global insurance renewal rates falling for the seventeenth consecutive period in the second quarter of 2017.

Unfavourable claims experience primarily from natural hazards and lower reserve releases. 42 Hartford to sell run-off life annuity business for 205 billion Insurance Journal December 4 2017. This generally means fewer insurance companies are competing for new customers as theyre more focused on working hard to make sure they can protect the customers they already have.

The report delivers insights from our experts into the current market conditions across key business insurance classes factors affecting the availability of insurance and the strategies to address these challenges. Globally successive years of poor insurer performance have been driven by more frequent and severe natural catastrophe CAT events rising attritional loss and social inflationary pressures affecting long-tail classes of business. These two states of the insurance market have impacts within the pricing and the extent of cover which insurers are preparing to.

The Australian insurance industry provides a broad range of property and casualty life and health insurance coverage to individuals and businesses. With business uncertainty continuing to affect insurance availability and cost Gallagher has released our Insurance market conditions report. During a hard market insurance companies tend to enforce stricter rules about what kind of risks they will insure.

Falling investment returns low interest rates. A soft market is generally characterised by low rates high limits and readily available cover. In a hard market premiums increase and capacity will generally decrease.

It acts as an important buffer for the Australian economy softening the financial impact of events on the public purse by funding claims out of the private sector. 3 This appears mainly due to an overabundance of capital particularly in the US market with industry surplus as of June 30 at an all-time high of 704 billion. Negotiating a hard insurance market SME owners and managers have a lot on their minds right now.

Broad coverage is also difficult to obtain in a hard insurance market. This can be caused by a number of factors. In a hard insurance market insurers have reduced capacity to write new policies.

One key change is the stabilisation of reinsurance costs a development caused in part by the growth of alternative reinsurance capacity in the US. At the top of the list is how they can best steer their businesses through the pandemic crisis which has put Australias economy into a recession for the first time since 1991. These disasters include cyclones floods Bush fires and major storms throughout Australia and throughout the world.

41 The Hartford signs agreement to acquire Navigators a global specialty underwriter Press release The Hartford Newsroom August 22 2018. In times like this keeping a lid on costs takes on even more urgency. 40 Charles Juniper 2018 Trends to watch.

There are indications that 2013 will be seen as the end of the hard property insurance market in Australia. Navigating the hard harket Q3 2021. Ben Rolfe June 16 2020.

Chief Broking Officer Aon Australia. Who we are. While businesses can do away with such.

4 Even record storm losses would be. Furthermore cover terms are unlikely to be negotiated with underwriters where standards are strict. KPMGs annual General Insurance Industry Review includes the financial results of all Australian general insurers up to 30 June 2019.

PwC has a deep team of insurance. Insurance profit for the year ended 30 June 2019 was down 12 percent to 4399 million a significant reduction on the previous two years annual results.

Top 10 Best Life Insurance Companies In The United States Infographic Portal Best Life Insurance Companies Affordable Car Insurance Life Insurance Companies

Pet Insurance Australia Fabric Stores Online Fun Worksheets Plushie Patterns

Why Is The Insurance Market Hardening Mckenzie Ross

Ibisworld Industry Market Research Reports Statistics Market Research Key Success Factors Marketing

Carte De L Australie Voyage Chambre D Enfant Australie Carte Affiche Decor De Salle De Jeux Art Mural Chambr Australia For Kids Maps For Kids Australia Map

How To Create A Memorable Customer Experience On A Budget How To Memorize Things Customer Experience Experience Design

Health Insurance In Australia Infographic Private Health Insurance Health Insurance Health

Suburb Profiles 20 Expert Insights Flipping Houses Suburbs House Prices

Interesting Facts About Life Insurance In Australia Shared By Brian Bergstrom Insurance Age Life Insurance Facts Life Insurance Quotes Life Insurance Companies

State Of The Australian Property Market September 2012 Property Marketing Infographic Marketing Real Estate Infographic

As The Nation Progresses Towards A Hopeful And Prosperous Future This 15th On Protection Day Take A Step To Secure Yo Life Insurance Insurance Car Insurance

When You Are Young Life Insurance Is Probably The Last Thing On Your Mind You Might Want To Rethink That I Have H Dental Coverage Budgeting Critical Illness

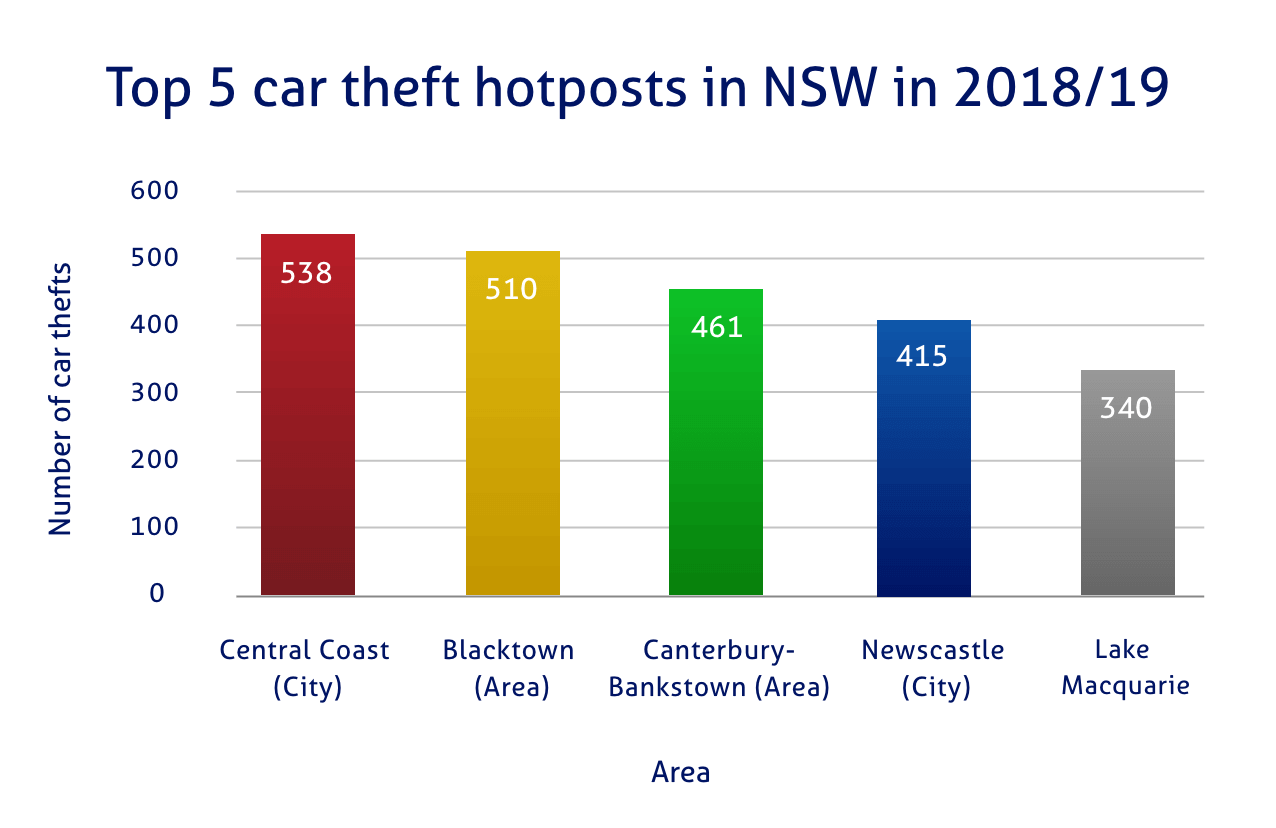

Car Insurance Nsw Compare The Market

If You Have Been Looking For A Way To Earn A Little Extra Money Or A Lot Arbonne Offers An Opportunity That Is Unp Arbonne May I Help You Arbonne 30

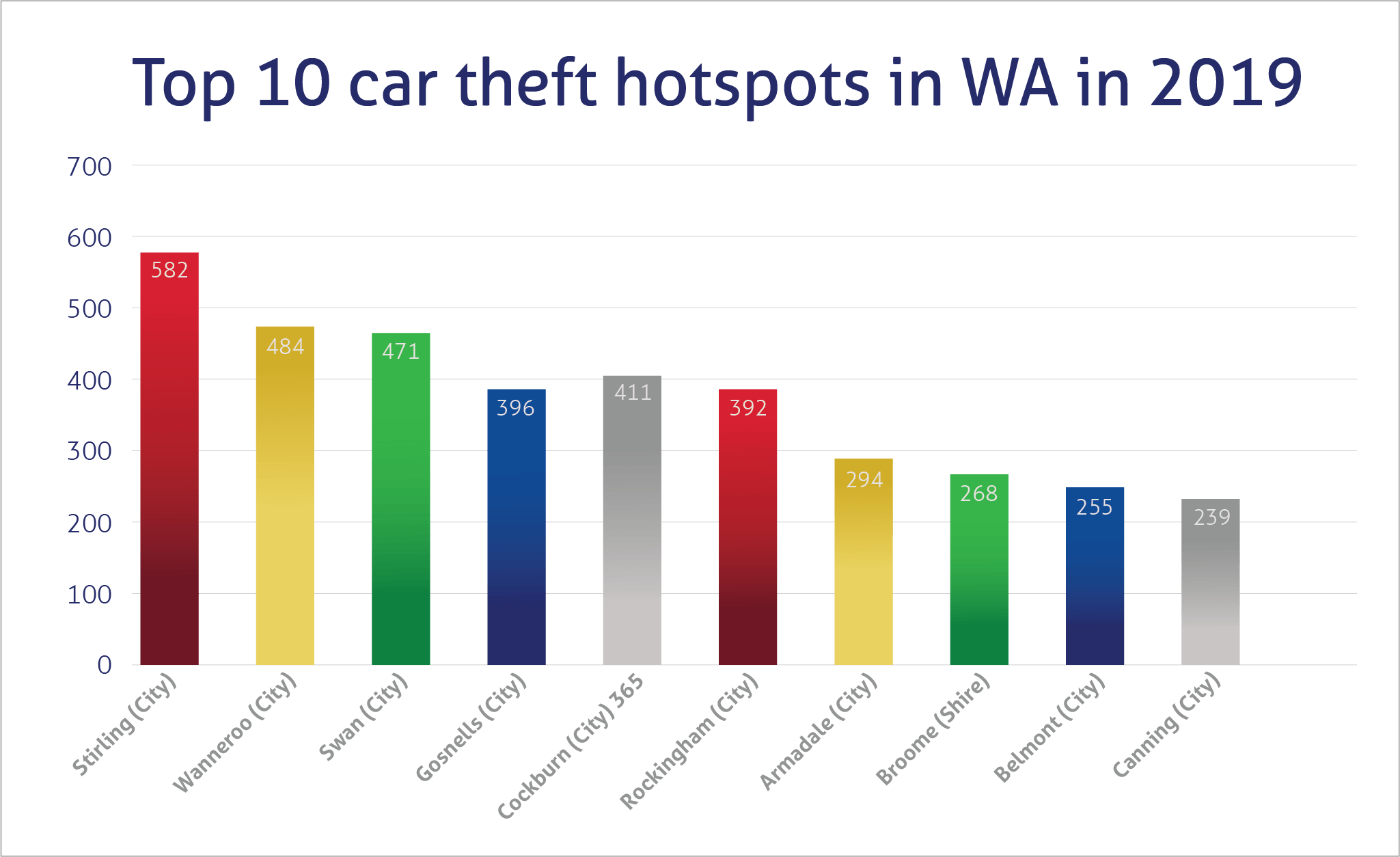

Car Insurance In Western Australia Compare The Market

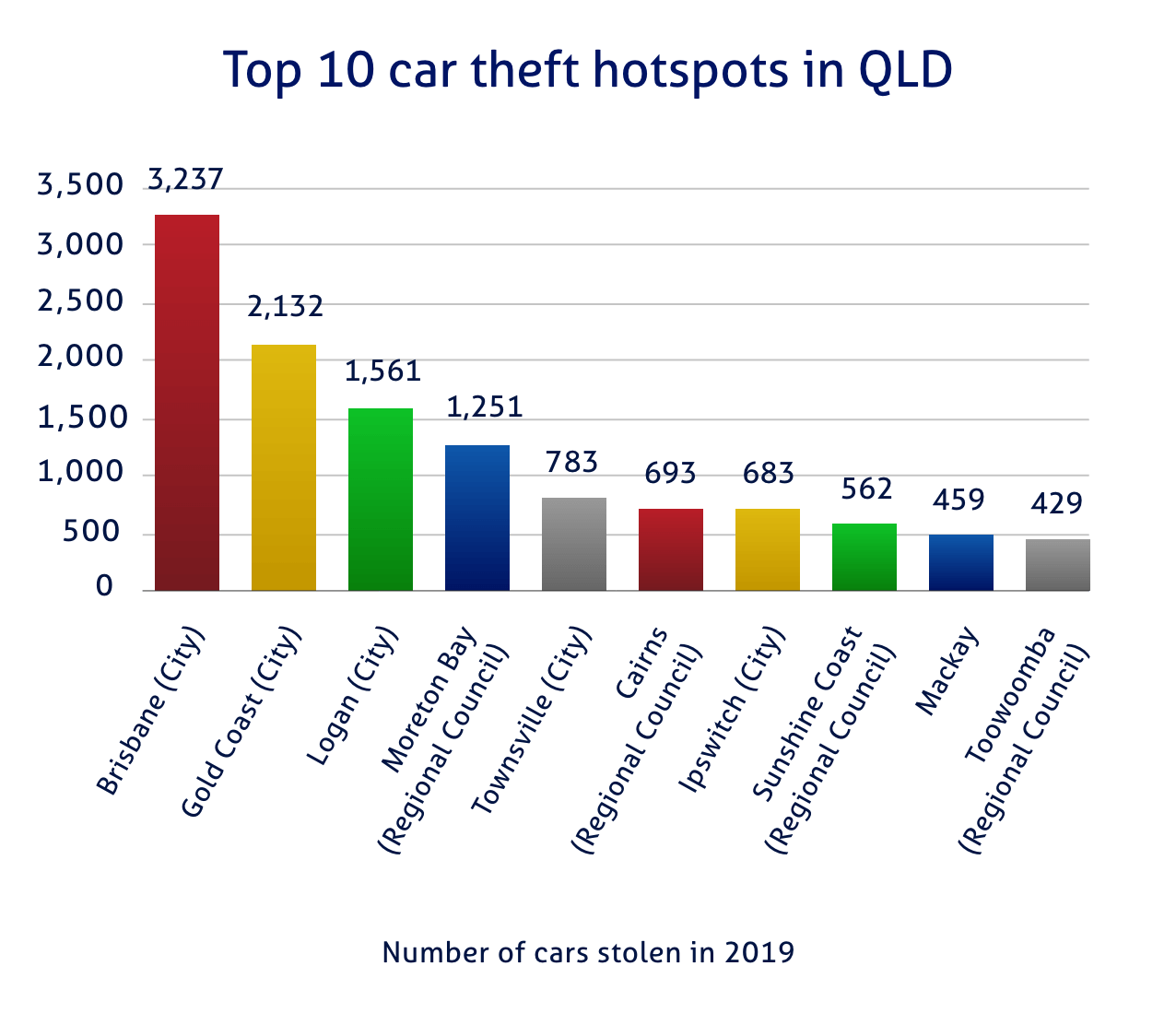

Car Insurance In Queensland Compare The Market

100 Insurance Marketing Ideas Tips Secrets And Strategies Insurance Marketing Insurance Sales Business Insurance

Post a Comment for "Hard Insurance Market Australia"