How Does Decreasing Life Insurance Work

The most obvious example is if youre repaying a mortgage. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

An Option Is The Decreasing Term Life Insurance Policy In Which The Premium Stays The Very Same B Financial Health Personal Finance Lessons Personal Finance

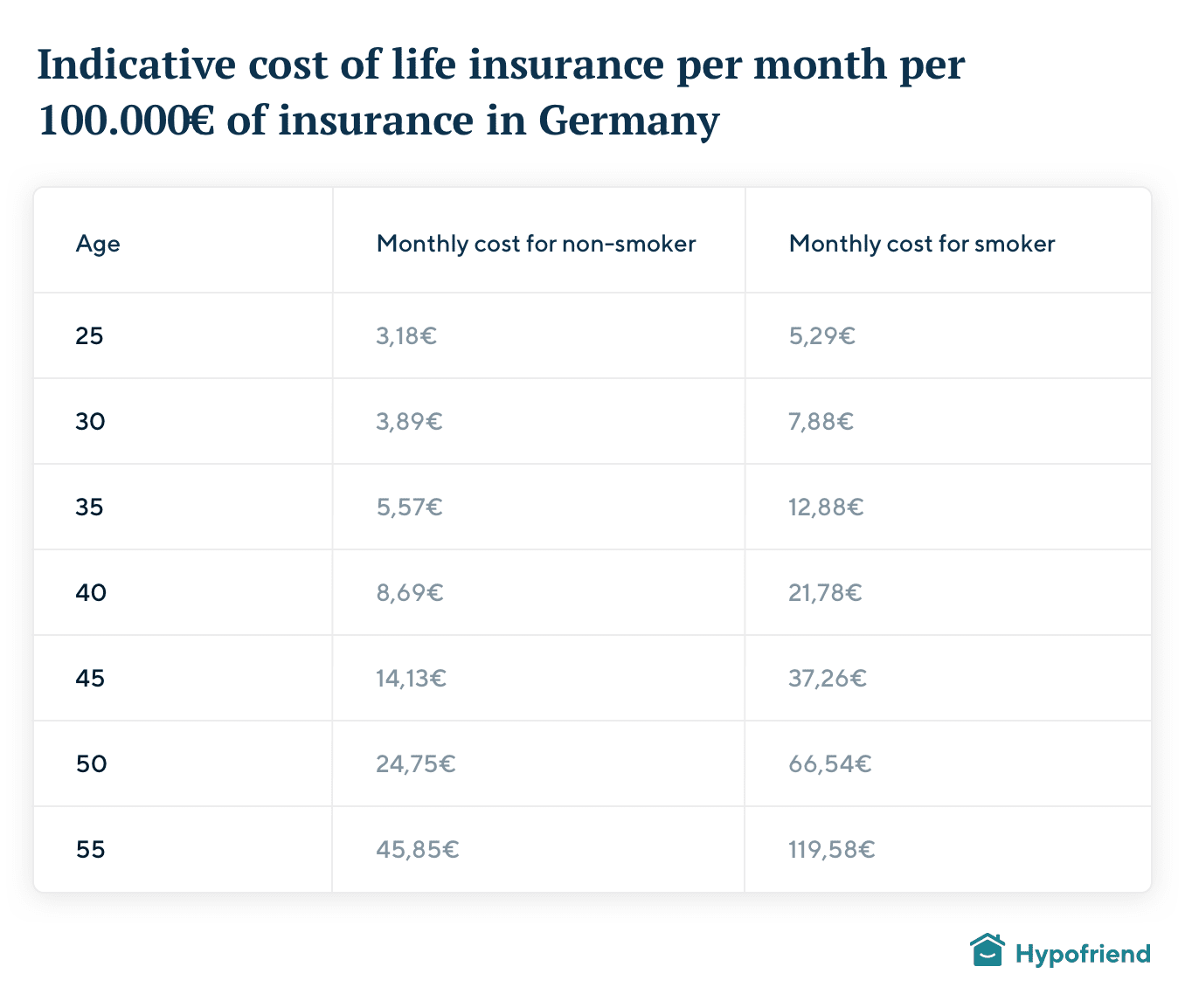

Decreasing term insurance is often cheaper than level term insurance.

How does decreasing life insurance work. A decreasing life insurance policy pays out less as time goes on. How exactly does decreasing term life insurance work. Decreasing Term Life Insurance is one of the most common types of life insurance policy you can buyIt is designed to pay out a tax free cash lump sum on death to ensure your loved ones are financially secure should the worst happen.

Premiums are usually constant throughout the contract and. You may also choose an offset mortgage where the amount of your savings determines the interest you pay on your mortgage balance. When you reach the end of your policy the pay-out will be zero.

You buy decreasing-term life insurance for a specific period of time the term. Decreasing term life insurance is aimed at people whose financial commitments reduce over time. How does decreasing term life insurance work.

How does decreasing term life insurance work. With our Decreasing Life Insurance a cash sum could be paid out if you die or are diagnosed with a terminal illness with a life expectancy of less than 12 months while youre covered by the policy. By the end of the term the amount paid out falls to zero.

Although payments stay the same over the term of the policy how much you pay each month is typically less than for level term life insurance. What Is Decreasing Life Insurance. You pay the same amount each month or year but your death benefit grows smaller.

How does a decreasing term life insurance work. Mortgage life insurance is life insurance you take out to cover the cost of your mortgage payments for your dependants if you or your partner pass away. When taking out decreasing life insurance you will be covered for a fixed period or term.

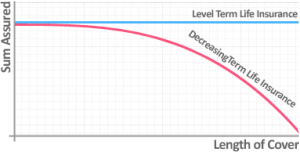

The level of pay-out decreases over the length of the policy. If a couple bought a house together and one died the other may struggle. The cash sum could be used by your loved ones to help pay off an outstanding mortgage.

Ive been looking at life insurance quotes for a few days now and am really struggling with the precise mechanics of a decreasing term insurance deal. When you arrange your mortgage you will arrange it on an interest-only or a repayment basis. How does life insurance on a mortgage work.

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. How does decreasing term life insurance work. Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time.

You purchase an initial face amount of life insurance at guaranteed level rate. How does it work. Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time.

Usually people buy a decreasing term life policy that lasts only for the amount of years that they need to cover a specific debta home mortgage car financing or student loans for example. It is a term-life insurance policy where the coverage decreases over the life of the policy a set period of time between 1 and 30 years. How does Decreasing Life Insurance work.

You then pay premiums on a monthly or annual basis and the amount the policy pays out falls as the term goes on also either month by month or year by year. On November 1 2018. You pay premiums either monthly or yearly and the total amount the policy will return decreases over that period.

As the years go by the insurance coverage reduces incrementally and eventually goes down to an established minimum say 10000 or even to zero in some cases. All the helpful faqs simply describe it as defined to. Decreasing term life insurance works differently compared to Traditional Term Life.

With traditional term life you have a fixed level premium that is guaranteed to never increase for the life of the policy and your death benefit is level. Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage. While a level term life insurance policy has a face value that remains constant over the life of the policy the death benefit decreases either monthly or annually for decreasing term insurance.

This is because it is designed to cover the cost of a mortgage debt which also becomes smaller over time. How Does Decreasing Term Insurance Work. How does decreasing term life insurance work.

Our Decreasing Cover pays out a single amount that reduces over the term of the policy. Decreasing term life insurance policies are available for terms lasting from one to 30 years. Youll take out a decreasing life policy for a fixed period of time called the term.

Decreasing term life insurance is a life insurance policy that is useful for a short period of time. How does decreasing term life insurance work. Decreasing term insurance is simple to understand.

Decreasing term insurance also known as DTA insurance is different from a standard term policy or level term life insurance in the payout structure.

Decreasing Life Insurance Life Cover Legal General

Implementing Multiple Life Insurance Policies Infographic Life Insurance Policy Life Insurance One Life

What Is Term Life Insurance Update 2021

Pin By Rushiel On Money Talk Life Insurance Quotes Life Insurance Marketing Life Insurance Policy

Life Insurance Cover Quotes Uk Budget Insurance

Life Insurance Cost Calculator Uk 2021 Drewberry

Decreasing Term Life Insurance Compare The Market

Pin By Aliviauhler22o9 On Truths Life Insurance Quotes Life Insurance Facts Life Insurance Sales

There Are Many Types Of Life Insurance Policies Which Are Available In The Uk Market Some Of Them A Life Insurance Quotes Life Insurance Policy Life Insurance

Decreasing Life Insurance Life Cover Legal General

Decreasing Life Insurance Life Cover Legal General

Insuring The Stages Of Life Life Term Life Income Protection

Life Insurance Cheat Sheet Family Title C Graphic Line Shutterstock Com Calculator C Timashov Ser Health Insurance Humor Life Insurance Agent Life Insurance

Pin On Knowledge About Insurance

Post a Comment for "How Does Decreasing Life Insurance Work"