What Does Decreasing Term Life Insurance Mean

Decreasing term life cover is designed to help your loved ones pay off your financial commitments such as a repayment mortgage loans or credit card balances if you pass away during the term of the policy. Your life insurance premiums are typically level for the life of the contract.

How Does Life Insurance Work Forbes Advisor

Decreasing term life insurance definition.

What does decreasing term life insurance mean. Decreasing-term life insurance ensures that if you die your loved ones wont have to face the stress of paying off your. Premiums are usually constant throughout the contract and. This is calculated by an interest rate set by your policy provider.

Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. When taking out decreasing life insurance you will be covered for a fixed period or term. What Is Decreasing Life Insurance.

A decreasing term life insurance policy typically works best to cover a loan or other financial obligation that will reduce in size over a known period of time. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. This type of insurance tends to be an economical way to protect your beneficiaries should you die unexpectedly during a period when you have substantial financial responsibilities.

Usually people buy a decreasing term life policy that lasts only for the amount of years that they need to cover a specific debta home mortgage car financing or student loans for example. Decreasing term life insurance policies are available for terms lasting from one to 30 years. Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance.

A decreasing term life insurance policys death benefit gradually decreaseseither monthly or annuallyover the span of the entire term. Decreasing term life insurance also known as mortgage term life insurance pays out if you die while your policy is active. Designed to help protect a repayment mortgage or similar debt decreasing-term life insurance can pay out a cash sum in the event of your death or if youre diagnosed with a terminal illness.

The amount your loved ones will receive decreases as time goes on. What is decreasing term life insurance. Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term.

By the time the term is ending there will be 0 death benefit available. What Does Decreasing Term Life Insurance Mean. Decreasing term insurance also called DTA insurance can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis.

You pay the same amount each month or year but your death benefit grows smaller. Decreasing term life insurance is a type of life insurance policy that pays out less over time. The size of the policy continues decreasing until either the policy pays out or until the end of the coverage period.

The death benefit will decrease on a monthly or annual basis. How often your benefit decreases and the amount it decreases is set when you buy your policy. What is decreasing term life insurance.

Decreasing term life insurance sometimes called mortgage insurance can also be purchased for a set term such as 5 10 20 or 30 years. Decreasing Term Life Insurance is one of the most common types of life insurance policy you can buy. Loan A loan is a sum of money.

If youre steadily paying off your mortgage in the event of your death your dependants would need less money to cover what remains of it as time goes on. It is designed to pay out a tax free cash lump sum on death to ensure your loved ones are financially secure should the worst happen. Decreasing-term life insurance is usually taken out to ensure a specific debt is covered usually a mortgage.

They soon found a solution. Because the potential value of a claim decreases as time goes on this type of policy. The table that describes how a given decreasing term policys coverage decreases over time is called a decreasing.

Its often used to cover the balance of a repayment mortgage because the total balance of the mortgage decreases over time and will be paid off in full at the end of the term. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. Decreasing term life insurance is a policy where the benefit declines on either a monthly or annual basis.

The decrease in the death benefit may occur monthly or annually. Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures. As your loan amount will decrease over time as you repay it the death benefit of your decreasing term life.

The exact amount of. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Ideally the size of the policy also decreases over the period until the coverage period concludes or until the policy pays out.

A decreasing term assurance policy is usually the same as a mortgage term assurance policy. With a decreasing term life insurance policy the amount of the death benefit decreases each year of the fixed term -- such as 20 years -- although the premium remains the same. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years.

In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance.

Term Life Insurance Policygenius

Decreasing Term Life Insurance Compare The Market

Term Life Insurance Explained Forbes Advisor

How Does Whole Life Insurance Work Costs Types Faqs

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

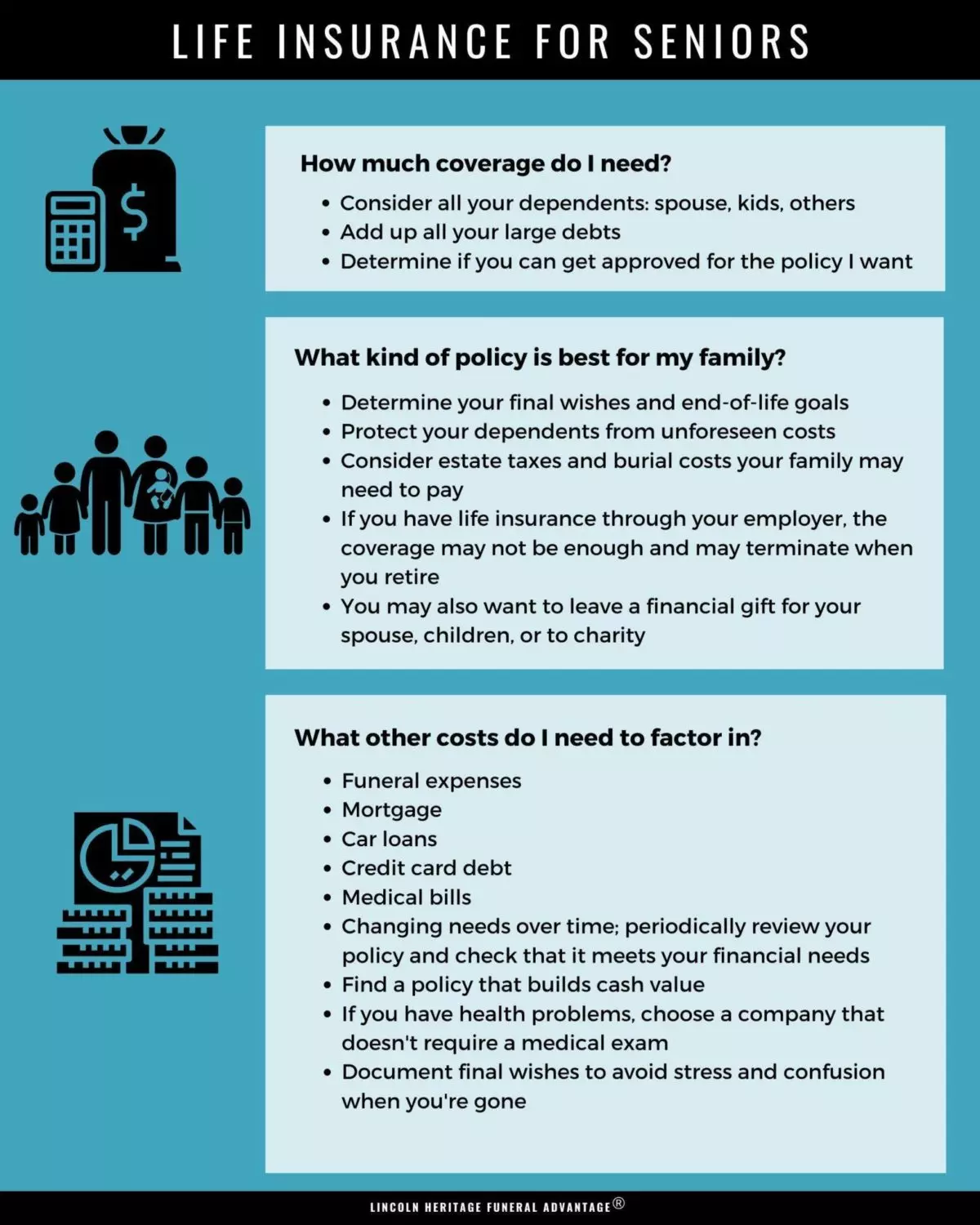

Best Life Insurance For Seniors

Banner Life Insurance Review Great Quotes And Coverage For Term And Universal Policies Valuepenguin

Implementing Multiple Life Insurance Policies Infographic Life Insurance Policy Life Insurance One Life

What Is Term Life Insurance And How Does It Work Money

Transamerica Life Insurance Review Wide Range Of Products Competitive Term Prices Valuepenguin

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Term Vs Whole Life Insurance Policygenius

Life Insurance Over 70 How To Find The Right Coverage

Insurance Industry Trend What Is The Difference Between Term And Whole Life Seniorli Whole Life Insurance Term Life Insurance Quotes Life Insurance Policy

Northwestern Mutual Life Insurance Review Low Rates And A Wide Variety Of Options Valuepenguin

Level Term Life Insurance Explained Life Ant

Post a Comment for "What Does Decreasing Term Life Insurance Mean"